05/2018

By Ricardo Amorim

In a country with so many functionally illiterate citizens, it is not surprising that financial illiteracy takes epidemic proportions. It is not surprising but it is alarming.

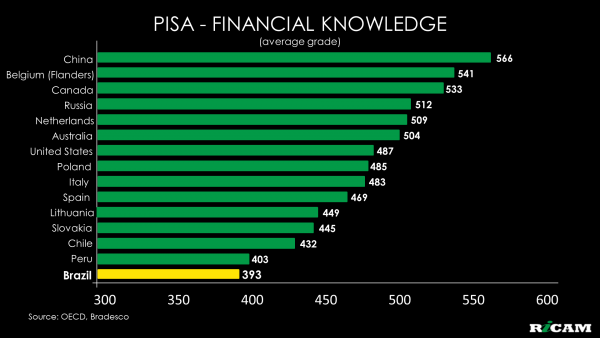

According to the PISA exams testing 15 year-old students in 15 countries, the young Brazilians are the most ignorant in finance. Even Peruvians, who are much poorer than the Brazilians, are ahead of us. The Chinese come out the leaders of the survey. Is it a coincidence that their per capita income in 1980 was 6% of ours and it is now more than ours? Precisely: an average Chinese earns more than the majority of Brazilians.

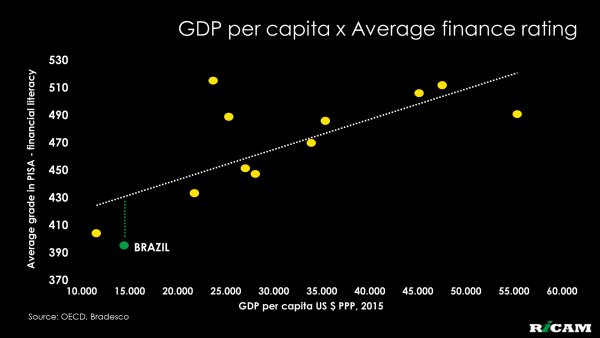

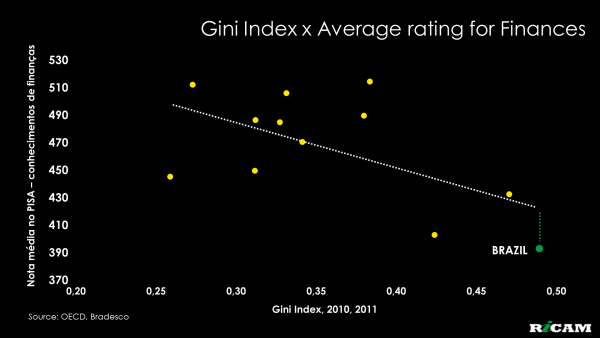

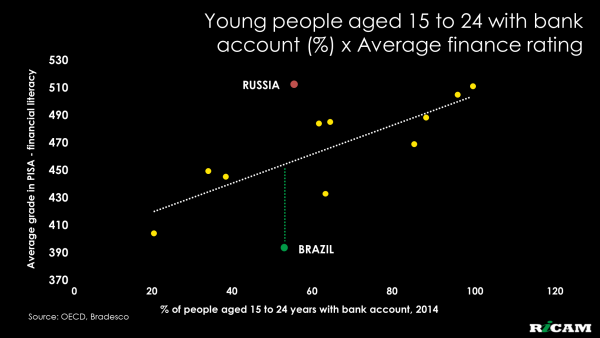

As was to be expected, the survey confirms that students who are good in maths, science and reading tend to know more about finance too. It is also not surprising that countries with higher per capita income, better income distribution or a higher percentage of the population holding bank accounts have better results in the finance exams. It is worthy of notice that in all cases the results of Brazilian students in finance are still worse than the per capita income, the income distribution or the extent of bank usage might suggest. There is, therefore, a specific problem in the teaching of basic finance in the country – depicted in the graphs below as the vertical distance between the position of Brazil and each one of the tendency lines.

Financial ignorance is not the privilege of young people. A survey carried out by SEBRAE shows that 77% of self-employed entrepreneurs earning up to R$ 81.000,00 yearly never attended a course or had any training in finance. 48% do not forecast expenses, 50% still use a paper notebook to register expenses, 39% do not record all their income and 34% do not check their cash balance – or do it once a month.

Subjects such as Gipsy culture and organic chemistry, for instance, are part of the mandatory basic syllabus, but finance is left out. How can you decently plan your personal or business life without knowing the first thing about basic finance?

Taking into account the financial ignorance prevailing in the country, it is easy to understand why tens of millions of Brazilians embarked on unpayable debts jeopardizing their financial future. The majority of them ignore the brutal effect of compounded interest on debt and investment, more so in view of the gigantic Brazilian interest rates. Considering, for example, a 400% a.a. interest rate – which is close to what is applied to overdraft rights or credit card dues – a debt of R$ 3.000,00 entered to buy a TV set in May 2015 would have become R$ 15.000,00 one year later, R$ 75.000,00 two years later and R$ 375.000,00 today. The buyer of a TV set three years ago owes an apartment today. Were they aware of this, would so many people have taken on such debt?

The same financial ignorance explains why rogue politicians manipulate Brazilians using public money. The same guy who pays more expensive food in the supermarket – due to high taxes meant to cover the cost of the public machinery – is grateful to the governing politician who gives him back a fraction of what our guy paid in taxes, via the “Bolsa Família” or any other public program.

Most of them do not understand that, if the total collection for Social Security is R$ 550 billion and the total benefits to be paid out is R$950 billion – as will happen in Brazil this year – the R$ 400 billion short will have to come from somewhere – more precisely, from the budget for health, education, infrastructure, security, etc… It is even more difficult to understand the future financial consequences of two demographic changes. Families have less and less children – reducing the number of people who will work and pay into Social Security in future – and people live longer – increasing the number of Social Security beneficiaries and for how long they will be paid benefits. Guess what this will do to the gap in the Social Security budget?

In short, in case we want to build a better and more prosperous country we must make long and fast strides in the financial education of all Brazilians. Financial education must be an important part of the official school syllabus. It is in the interest of all companies to invest in providing their employees better financial knowledge which will result in better decisions in their personal lives and for the companies they work for. Above all, it is the responsibility of each one of us to find sources of financial education for ourselves and for our children.

Ricardo Amorim is the author of the best-seller After the Storm, a host of Manhattan Connection at Globonews, the most influential economist in Brazil according to Forbes Magazine, the most influential Brazilian on LinkedIn, the only Brazilian among the best world lecturers at Speakers Corner and the winner of the “Most Admired in the Economy, Business and Finance Press”.

Click here and view Ricardo’s lectures.

Follow me on: Facebook, Twitter, YouTube, Instagram e Medium.

Translation: Simone Montgomery Troula