IstoÉ Magazine

07/2012

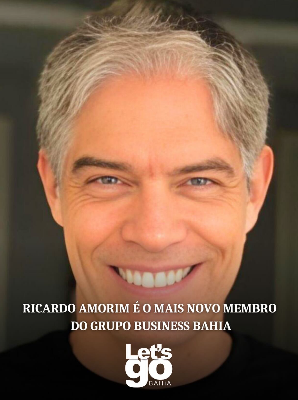

Published by Ricardo Amorim

Fears of real estate bubble bursting in Brazil are premature

The real estate market is passionate. For many, buying a property is the most important financial decision of their lives. For investors, sometimes it is a potential for great profits. For the country, a powerful growth engine and employment generator.

Since 2008 I have been refuting claims that Brazil has a housing bubble about to burst. Since then, housing prices doubled, and in some cases tripled.

Impressed with the pace of real estate activity and the strong rise in prices, I decided to re-check my earlier studies on the subject.

I analyzed the real estate bubbles of all the countries from which there is available data since 1900. I ignored only regional real estate bubbles, like the search for gold in West America.

Some conclusions stood out. First of all, real estate bubbles usually involve strong construction activity. In order to make the construction data comparable across countries and periods, I analyzed the annual cement consumption per capita in each country at the year the bubbles bursted. I found no bursting bubble with annual cement consumption of less than 400 kilos per capita. Recently, in the USA, it was almost 450Kg, in Spain, it was over 1,200 kilos and in China nowadays, cement consumption is even higher: 1,600 kilos per capita and the bubble has not burst yet. In Brazil, my estimate points to 349 kilos of cement per capita, today.

Secondly, housing bubbles are usually characterized by the decoupling of (the high) prices when compared to income (the buyer’s ability to make payments). Considering the number of yearly salaries required to buy a property in major cities around the world, none of the cities in Brazil currently rank among the 20 most expensive. On the other hand, Brasilia, Rio de Janeiro, Salvador and Camboriu are among the 100 most expensive. However, even by this parameter, Brasilia, the country’s most expensive city, is still two and a half times cheaper than Rabat, Morocco, the world’s most expensive.

The air that inflates any investment bubble, be it real estate or not, is always the plentiful supply of credit. After all, it enables investors to buy something that they could’ve never dreamed of with their incomes. All real estate bubbles bursts Ianalyzed happened when total real estate loans in that country exceeded 50% of GDP. In the US, in 2006, a year before prices began to fall, mortgage loans were at 79% of GDP. In Brazil, despite all the growth in recent years, that number is at only 5% of GDP.

Indeed, it is always a sudden disruption in credit supply or rise in the cost of credit that’s associated with a bursting bubble. But in Brazil, the exact opposite is happening. Mortgage portfolios are expanding while the cost of debt is coming down.

For all that I’ve researched, I conclude that it’s highly unlikely that the real estate bubble will burst in Brazil, at least anytime soon. If Brazilian buyers are putting off their dreams of home ownership by fear of a bubble, they can relax for now.

So will real estate prices continue to rise at the pace of recent years? Hardly. Brazilian home prices are already much higher than before and in some specific cases high as compared to other countries.

Chances are that prices will keep increasing at a much more modest pace. In some cases, even minor price corrections may be possible, and even beneficial, which is exactly what it’s needed to ensure that bubbles don’t completely burst in the future.

Ricardo Amorim

Economist, one of the hosts of the Manhattan Connection TV show at Globonews, CEO of Ricam Consultoria and international keynote speaker.