WRONG DIAGNOSIS: Myths about Brazil’s deindustrialization lead the government to misguided spending

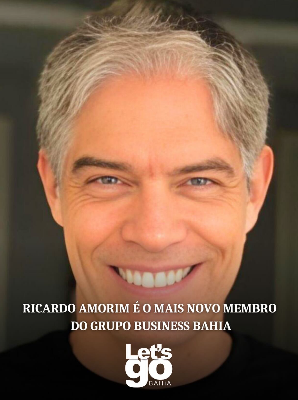

By Ricardo Amorim

As any freshman in medical school learns, to treat an illness you must first diagnose the patient correctly. Mistake chicken pox for the measles, and the chances of a cure drop considerably.

Today, there’s a near unanimous consensus about what’s ailing Brazil: a severe case of deindustrialization, brought on by the appreciation of the real. The main symptom, accordingly, is a plunge in national competitiveness.

Both the diagnosis and its supposed monetary cause are mistaken. Consider the numbers. Brazilian industry has been shattering record after record. Industrial output grew by more than 10% last year, the highest rate in 25 years. The number of manufacturing jobs created was the highest in Brazil’s history. Ditto for the percentage of companies planning to hire more workers this year. The volume of investment has also grown. In 2000, our industrial park was the 10th largest in the world. Now it ranks 6th, larger than France’s and the United Kingdom’s.

So has everyone gone crazy? Not at all. Effectively, the share of imported industrial products in the Brazilian market is growing, while the volume of exports has fallen. In terms of sheer volume, our exports – excluding automobiles – are a quarter lower than three years ago. Add to that the fact that for each of the last eight years, retailing has outpaced industry. However, the reasons for the disparity in economic performance are far more complex and profound than simply the fall of the US dollar.

Last year, exports to the United States – our top market for manufactured goods – were down 36% in volume from the period just prior to the financial crisis. Likewise, exports to Japan and Europe have yet to return to pre-crisis levels. This is a direct reflection of the profound contraction of consumption in those markets. The result is that industries here and abroad are redirecting their goods to the booming Brazilian market. Meanwhile, our exports to China – the world’s fastest growing economy and the leading importer of our raw materials – have jumped 77% in volume since the crisis, to say nothing of the growth in value. In short, shrinking industrial exports to the rich nations and rising imports from those nations do not reflect our fragility, but theirs.

And yet because government blames the country’s industrial difficulties on an appreciating exchange rate, Brasilia has been fighting to contain the real. One measure has been a colossal accumulation of hard currency reserves – a kind of insurance policy against crises – that in the last eight years have grown almost ten-fold.

But insurance comes at a cost. In order to buy up dollars, Brazil must sells bonds that pay 11 percent a year, while US Treasury Notes pay out only 3 percent interest yearly. The difference – multiplied by the country’s total reserves, currently $320 billion reserves – costs Brazil more than $25 billion a year.

So while the country, laudably, is investing heavily in infrastructure (up by more than 50% in real terms over the last four years) since 2009 Brazil has spent far more on maintaining our reserves than on roads, airports, railroads and ports – precisely the sort of investment that could make the country more competitive. By investing more on infrastructure and less on reserves, the government could reduce taxes and so stimulate both production and consumption.

We diagnosed the wrong disease and are now spending good money on the wrong treatment. If Brazilian authorities were in medical school, they would have flunked out in their freshman year

Último dia de Summit 2025 tem palestra de Ricardo Amorim sobre inovação, IA e gestão pública

06/2025 Carol Polidoro / UPIARA O último dia do Summit Cidades foi marcado por uma programação inspiradora — e, mesmo com a forte chuva que